Last year I blogged Vendor Acquisitions & Partnerships. The main purpose of that blog was to give myself an overview where all that technology we use on a daily base comes from. Almost a year later, it’s time for an update. Maybe this time I can give some of my own insights on what’s happening out there.

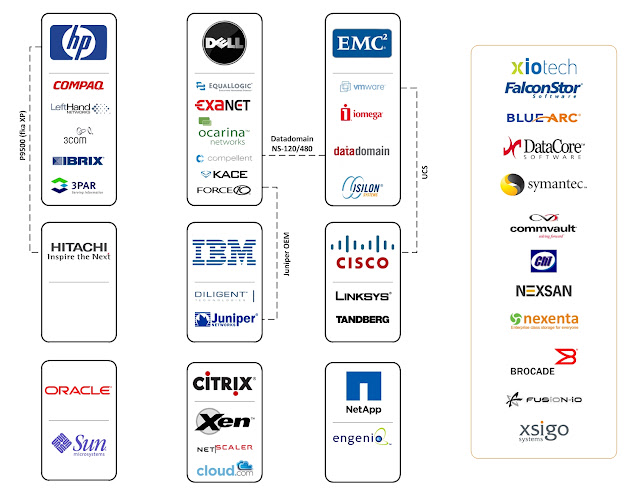

So here’s how the world looks like today:

UPDATE – 8/9/2011 – HDS Buys BlueArc

UPDATE – 26/11/2011 – LSI buys SandForce (SSD)

What happened?

HP did no big acquisitions. But they did loads of other things that are worth mentioning. For example: StoreOnce ! For the first time in years HP announces a product that comes out of their own labs. And they nailed it. StoreOnce gives you the ability to dedupe blocks up to 20:1 resulting in only 5% of the original storage size. Now that gives us finally the opportunity to keep our backups on disk for a longer period of time (or even forever!). Is that all they did? No, HP is strongly working on integrating everything together (the Converged Infrastructure story) and using their knowledge in world leading legacy hardware to use that to create new solutions. This results in solutions as the e5000 and x5000. Two differerent solutions on identically the same hardware: a 3U box with 2 blades and a 16-disk cabinet. The first one ships as a pre-installed Exchange Cluster, the second as a pre-installed Windows Storage Server cluster. Nice job of the solutions teams.

DELL is on a roll. In 2007 Michael Dell said he was going to the Enterprise market. Forget about the “online-PC-shop only” strategy, we’re going big! The acquisition of Equallogic was the first step in that direction. After losing the 3PAR-war last year to HP ($2.4 billion), they didn’t let that stand it their way. Before 2010 was over, DELL bought Compellent ($960 million). If you didn’t knew better, you’d say they fought that war with that in mind … What’s next on the list? Well, we don’t have decent networking yet. The PowerConnect is a good product (especially together with the EQL) but its not the data-center product. So everybody expects DELL to buy Brocade, their OEM partner for a long time now (the other one is Juniper but we know where that resides now). And what happens, they buy Force10! We’ll see what that will give in the nearest future but this really makes that step into the Enterprise Class reality. So what does DELL do with those acquisitions? Well, last year DELL bought Ocarina (software dedupe) and Exanet (NAS). This already translated into the new FS7500 NAS head for the Equallogic family. 2 X 1U High available NAS controller with a 2U battery. It’s based on the Exanet software and I’ve been told that for the next update release the Ocarina dedupe should be a new feature of this same appliance. Besides acquisitions DELL still has some OEM partnerships such as Juniper appliances, IBM tape library and the EMC DataDomain and NSxxx FC arrays. However DELL finally came up with a version of de MD3600 with FC controllers (MD3620fc). Together with the Compellent arrays this could lead to an end of the DELL EMC times.

EMC is the 3rd big boy out there. What do I love about EMC? It’s a solid company making solid storage solutions for decades now. But what they do with their acquisitions is not really my kind of thing. And the communication around it is even worse. Let me explain: EMC announced the biggest event of the year and that they would be breaking records! Did they lie? No, they put more people in a Mini than anyone has ever done before. And some kind of Evil Knievel Jr. jumps over more Storage Arrays than anyone has ever done before. Is that what we were waiting for? No, give us new products and solutions. Ok, we’ll give you over 40 new products! Waaw you’d say? Nope, again disapointment. The new products are jus the old products with a new front cover (VMAX). Nothing more nor less. The only new product I saw was the VNXe. And then they showed DataDomain and Isilon. Whats new? Nothing. It’s the same products as they were before. Both great products but what a fuss about nothing? I’ll even go one step further (this is the part about handling acquisitions). If you were an EMC partner you are not an Isilon partner and if you were an Isilon partner, you’re not an EMC partner. Say what ?!?

A last example was the benchmarking BS. For decades now EMC has rejected all open benchmarks. Suddenly they announced to join the SPC and shortly after that they revealed breaking all former SPC records. What they did not mention was with what solution they did that! Hundreds of SSDs on several arrays ($/IOP? – $/TB?). So the only thing that happens here is that EMC gives itself some free publicity on technology websites that don’t think that far. And if you pop up that question the only answer they can give is: that’s why we don’t rely on open benchmarks.

My answer: if you’re not making crap, don’t sell BS!

At Hitachi, IBM, Cisco and Oracle there is not so much movement, or not really in my area of work so I can’t really make an opinion on these.

Citrix did a new acquisition this month: Cloud.com There was not that much rumor about it on Twitter so it seems not to be that big deal. If you look at what this does it triggers me anyhow. Cloud.com is one of the founders of OpenStack.org on wich DELL (link) and HP (link) have announced this week to be fully supportive.

NetApp (aka NotApp). Ok, I already sold my opinion between the brackets 🙂 I’m really sorry but I cannot take this company serious. First they brag for years that their one-size-fits-all is the best solution in the market. Why would you do storage tiering en virtualization on block based storage if you can have NetApp? And guess what? This year they bought engenio (an LSI company). Euh, say what? Yes, a SAS, iSCSI and FC frontend array. By the way the only solution i know in the market that does SAS direct attached & Network based presentation together at the frontend. One should think they might lose the arrogance a bit. Nothing of that kind happens. Every few weeks some NetApp blogger attacks one or all other vendors with loads of crap/fud. I’ll just give one example. Early 2011 NetApp announced they were the biggest growing company (we’re smashing all competition!) in the storage market with a growth of +35%. Big applause please! Well guys, did you know that HP as a company grew more last year that NetApp is even worth? Wanna play with the big boys? Grow up instead of growing out.

What’s still out there?

There are still some smaller players available. Therefore I added a block of “free-agents” that can be drafted (did I mention I like Football a lot). Most of them were already in my last years blog but I updated it with some other storage software solutions.

But there is something else besides the storage solutions an-sich nowadays. We already managed to get higher volumes on a small footprint (larger disks, no-zero technologies, dedupe,…). We also managed to get more IOPs out of that same footprint by adding SSDs to the array. But somehow at some point that is not enough. For larger VDI or SAP environments you’d need tons of SSDs to provide the necessary IOPS. There are some companies out there such as FusionIO and XSIGO that will handle those requests before they hit the array. Definitely worth looking into and possible acquisition targets.

What’s Next for the big boys?

* HP & DELL: besides pushing your own strategies on management (ex. DELL Kace), make sure you are completely ready for Windows Server 8, Hyper-V 3 and System Center Stack 2012! The first one who can monitor AND manage all its servers, storage and networking hardware here will have a huge advantage over the other. Right now, most integration packs are not making it.

* DELL: give us a decent alternative for block based dedupe & replication (such as HP StoreOnce and EMC Datadomain). After that, cut the bonds with EMC, they’ve got nothing you can’t do on your own.

* EMC: I’ll just repeat my last line in your praragraph: If you’re not making crap, don’t sell BS!

LINKS:

HP StoreOnce

HP Converged Infrastructure

HP E5000 – Microsoft Exchange in a box

HP X5000 (G2) – Micosoft Storage Server 2008R2 cluster in a box

DELL Compellent

DELL – Force10 networks

DELL FS7500 – NAS head for Equallogic

DELL MD36x0f – entry Fibre Channel storage

EMC VNXe

EMC DataDomain

EMC Isilon

Citrix Cloud.com

OpenStack.org

FOOTNOTE: If I say something wrong, please correct me. If you are offended, ask yourself why!